Decoding Car Deals: Lower APR (Annual Percentage Rate) or Rebate – Which Saves You More?

- Jul 30, 2024

- 1 min read

When buying a car, you’re often faced with an intriguing choice: Should you go for a lower Annual Percentage Rate (APR) on financing or snag that tempting rebate from the dealer? Each option has its perks, and knowing their advantages can steer you towards a smarter financial decision:

Lower APR (Annual Percentage Rate)

The annual interest rate you pay on your car loan.

Lower APR means less interest paid over the loan's life, reducing the car's overall cost.

Beneficial for longer financing periods.

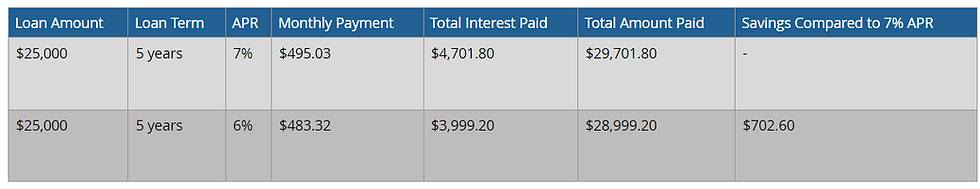

A 1% reduction in APR on a $25,000 loan over five years can lead to significant savings. For example, at 7% APR, the total interest paid over the life of the loan is $4,701.80. When the APR is reduced to 6%, the total interest paid drops to $3,999.20. This 1% reduction in APR saves you approximately $702.60 in interest over five years.

Rebate:

A discount applied directly to the car's purchase price.

Reduces the amount you need to finance.

Can lower your monthly payments and the total interest paid.

Example: A $2,000 rebate on a $25,000 car reduces the financed amount to $23,000.

How to Decide:

Compare the total cost of the car with each option.

Calculate the total amount paid over the loan term with the lower APR versus the amount saved with the rebate.

Use online calculators or consult with a financial advisor to determine the best choice for your financial situation.

Ultimately, whether you choose the lower APR or the rebate depends on your budget, loan terms, and long-term financial goals. Consider all factors to make the best decision for your situation.

Simplify data analysis with Percentage Calculator. Ideal for titration results, viral infectivity rates, or comparing stock efficacy, it streamlines percentage calculations with accuracy and ease. Designed for researchers, it helps interpret experimental changes and concentration differences, making complex data more accessible, reliable, and efficient for scientific decision-making.